Financial Dreams: Navigating Family Goals with Precision

Setting and achieving family financial goals is key to building a secure and prosperous future. Explore practical strategies for defining, planning, and attaining your family’s financial aspirations.

Defining Clear Financial Objectives

Begin by defining clear and specific financial objectives for your family. These could include short-term goals like creating an emergency fund or long-term goals such as saving for a home or funding your children’s education. Clearly defined goals serve as the foundation for effective financial planning.

Creating a Realistic Budget

Crafting a realistic budget is fundamental to achieving family financial goals. Categorize expenses, allocate funds to necessities, and ensure there’s room for savings. A well-structured budget provides a roadmap, guiding your family towards successful goal attainment.

Prioritizing Short-Term and Long-Term Goals

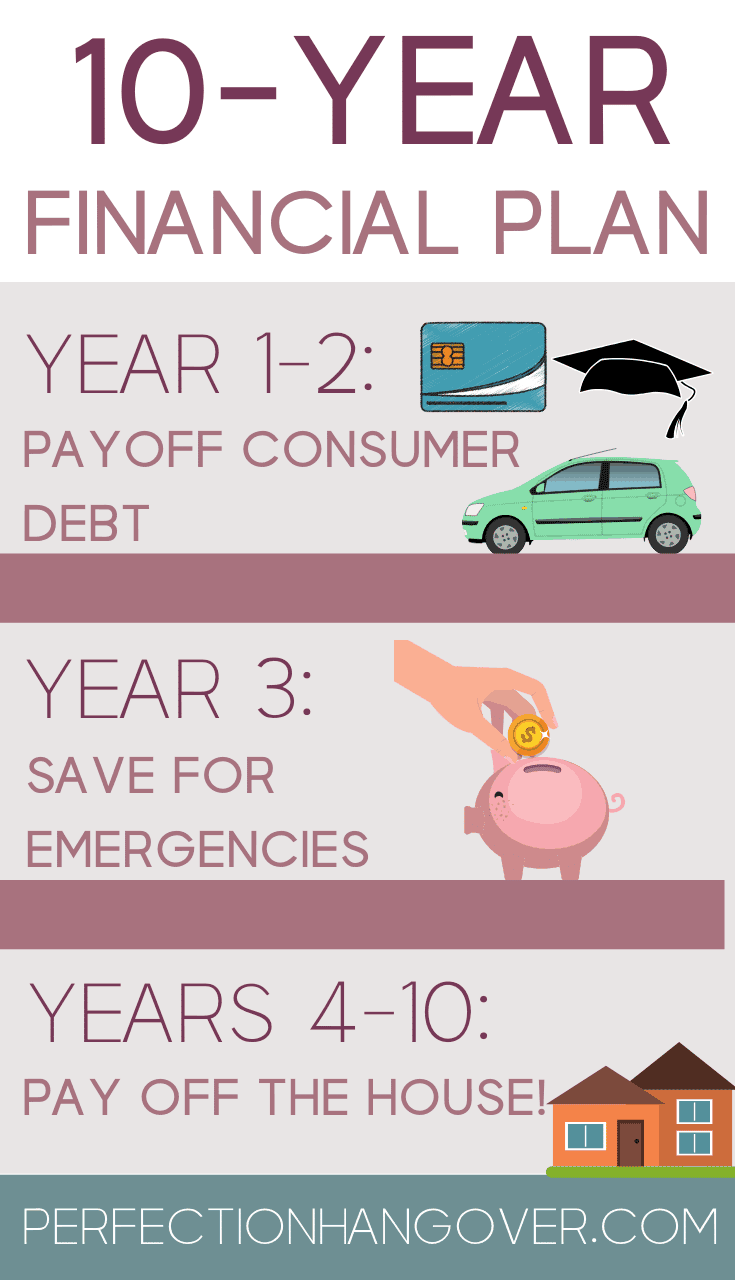

Prioritize both short-term and long-term financial goals. Short-term goals might involve reducing debt or building an emergency fund, while long-term goals could include retirement planning or investing in real estate. Balancing these priorities ensures a comprehensive and sustainable approach.

Implementing SMART Goal Setting

Utilize the SMART criteria (Specific, Measurable, Achievable, Relevant, Time-bound) when setting financial goals. This approach adds precision to your objectives, making them more achievable. SMART goals provide clarity and focus, enhancing your family’s commitment to the financial planning process.

Building an Emergency Fund

Establishing an emergency fund is a crucial component of family financial goals. Allocate funds regularly to create a financial safety net for unexpected expenses. An emergency fund provides peace of mind and safeguards your family’s financial stability during challenging times.

Saving for Education and Future Expenses

Allocate funds for education and future expenses. Whether saving for your children’s education or planning for major life events, a dedicated savings plan ensures financial preparedness. Strategic saving allows your family to navigate significant expenses with ease.

Investing for Long-Term Growth

Explore investment opportunities for long-term financial growth. Consider diverse options such as retirement accounts, index funds, or real estate. Strategic investments contribute to wealth accumulation and lay the groundwork for a secure financial future.

Regularly Reviewing and Adjusting Financial Plans

Regularly review your family’s financial plans. Life circumstances change, and goals may need adjustment. Periodic assessments allow you to realign your financial strategy with current needs, ensuring continued progress towards your family’s aspirations.

Promoting Financial Literacy Within the Family

Foster financial literacy within your family. Educate family members on budgeting, saving, investing, and the importance of financial goals. Involving everyone enhances financial awareness and encourages a collective commitment to achieving shared objectives.

Celebrating Milestones and Staying Motivated

Celebrate milestones along your financial journey. Acknowledge achievements, whether big or small, and use them as motivation to pursue the next goal. Positive reinforcement enhances your family’s commitment to long-term financial success.

In conclusion, navigating family financial goals requires a thoughtful and strategic approach. To explore more insights and tips on effective financial planning, including goal-setting strategies, visit FirstBaseGloves.net. This resource offers valuable information to support families in making informed financial decisions and building a secure financial future.