Sustainable Budgeting: Nurturing Family Finances

Nurturing Financial Wellness: The Essence of Sustainable Family Budgeting

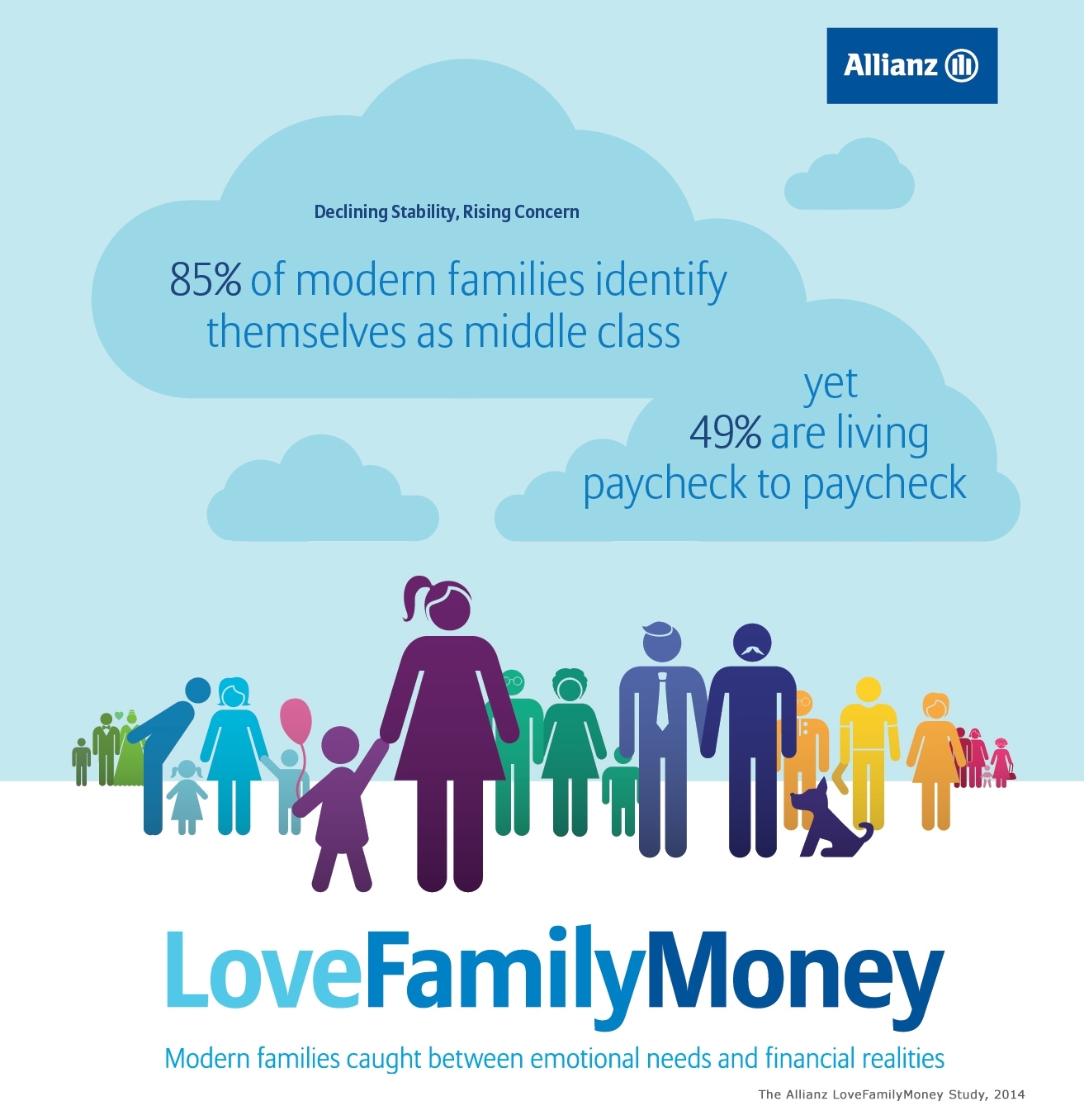

Family finances form the bedrock of a secure and fulfilling life. Sustainable family budgeting goes beyond mere financial planning; it’s about creating enduring financial habits that support the well-being of the entire family. In this article, we’ll explore the principles and practices that contribute to sustainable family budgeting, fostering financial health for the long term.

Understanding Sustainable Family Budgeting: A Holistic Approach

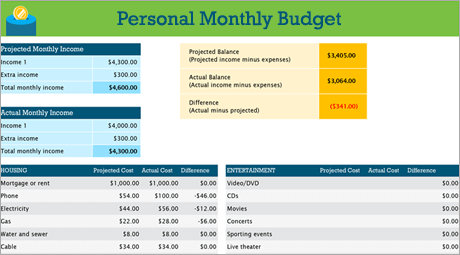

Sustainable family budgeting is not just about numbers on a spreadsheet; it’s a holistic approach to managing and nurturing family finances. It involves considering the long-term impact of financial

:max_bytes(150000):strip_icc()/girlsopeningpresents-fd61caee5d4b4898a7aa670a6e796c35.jpg)

:max_bytes(150000):strip_icc()/RecircimageforSpotlight-f9500cefbb204fa9aaf63d3f95ef4656.png)

:max_bytes(150000):strip_icc()/budget-c859a4e77f744197b0340b1250fc48d0.png)