Navigating a Secure Future: Family Financial Stability

Achieving and maintaining financial stability is a common goal for families. Explore key strategies and practices that contribute to family financial stability, providing a foundation for a secure and prosperous future.

Building a Solid Financial Foundation

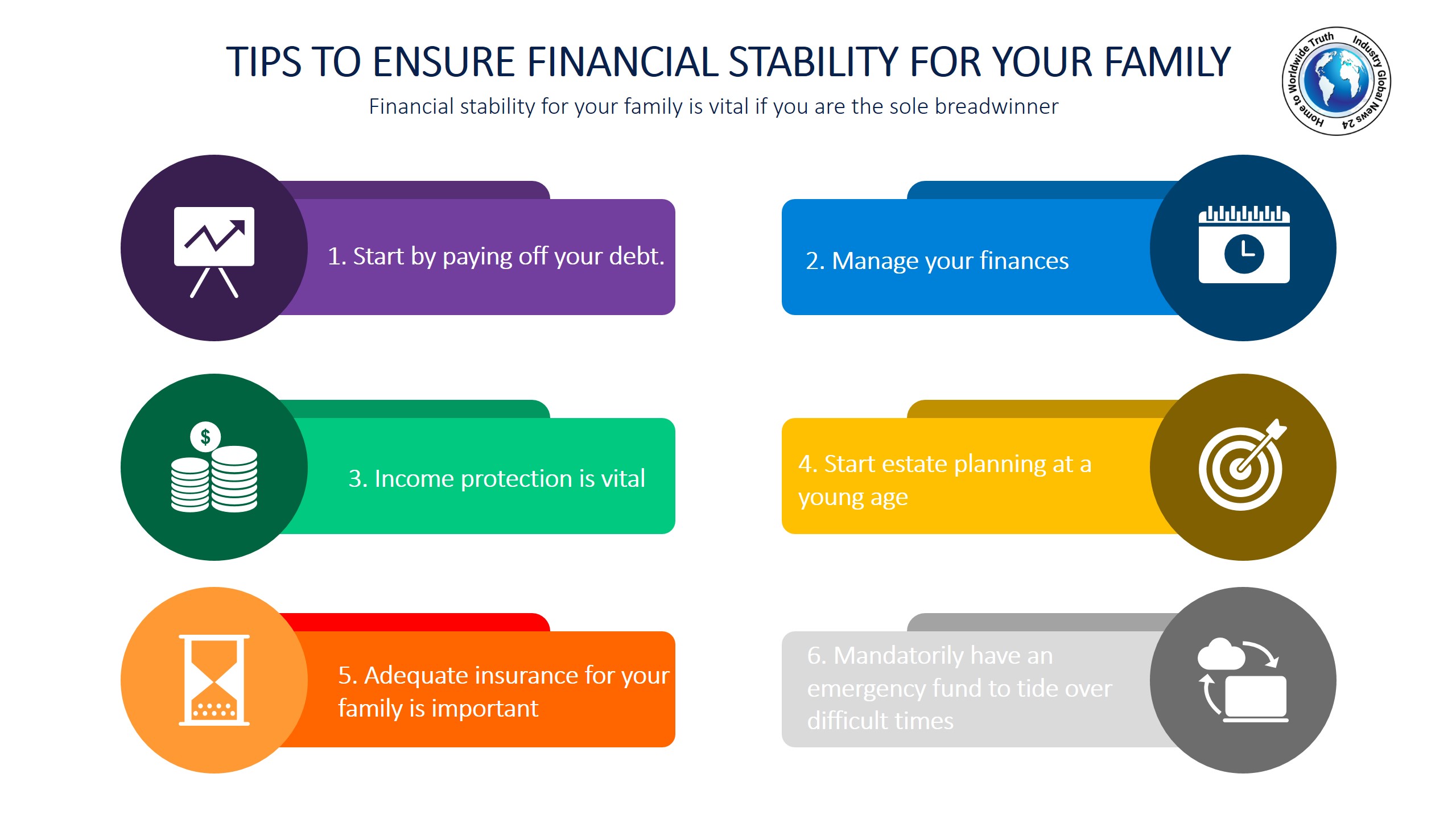

The journey towards family financial stability begins with building a solid financial foundation. This involves understanding and organizing key aspects of finances, including income sources, expenses, debts, and savings. A clear financial picture allows families to make informed decisions.

Creating and Adhering to a Budget

A crucial element of family financial stability is the creation and adherence to a budget. A well-structured budget allocates funds for essential expenses, savings, and investments. Regularly reviewing and adjusting the budget ensures that it remains aligned with the family’s financial goals and priorities.

Prioritizing Emergency Funds

Financial stability requires a safety net for unforeseen circumstances. Prioritizing and consistently contributing to an emergency fund is essential. This fund acts as a financial cushion during unexpected events, reducing the reliance on credit and supporting the family’s overall stability.

Smart Debt Management Strategies

Effectively managing debt is key to achieving family financial stability. Prioritize high-interest debts for repayment, explore debt consolidation options, and avoid accumulating unnecessary debt. Strategic debt management frees up resources for savings and investments.

Investing for Long-Term Goals

Investing plays a crucial role in family financial stability. Diversify investments across various asset classes such as stocks, bonds, and real estate. Regularly review and adjust investment portfolios to align with the family’s financial objectives and risk tolerance.

Promoting Financial Literacy Within the Family

Fostering financial literacy within the family is a proactive step towards stability. Educate family members about budgeting, saving, investing, and making informed financial decisions. A financially literate family is better equipped to navigate challenges and sustain stability.

Encouraging Smart Spending Habits

Smart spending habits contribute significantly to family financial stability. Encourage family members to distinguish between needs and wants, practice mindful spending, and seek value for money. Cultivating these habits leads to more efficient use of financial resources.

Planning for Education and Retirement

Financial stability involves planning for the future. Allocate funds for education savings and retirement planning within the family budget. Early planning allows for the compounding effect to work in favor of long-term financial goals.

Regularly Reviewing and Adapting Strategies

Family financial stability is an ongoing process that requires regular review and adaptation. Periodically assess the family’s financial situation, track progress towards goals, and make necessary adjustments. An adaptive approach ensures sustained stability in changing circumstances.

For additional insights and resources on achieving family financial stability, consider visiting Family Financial Stability for tools and guidance. Remember, by implementing these strategies, families can navigate the path to financial stability and build a secure future.