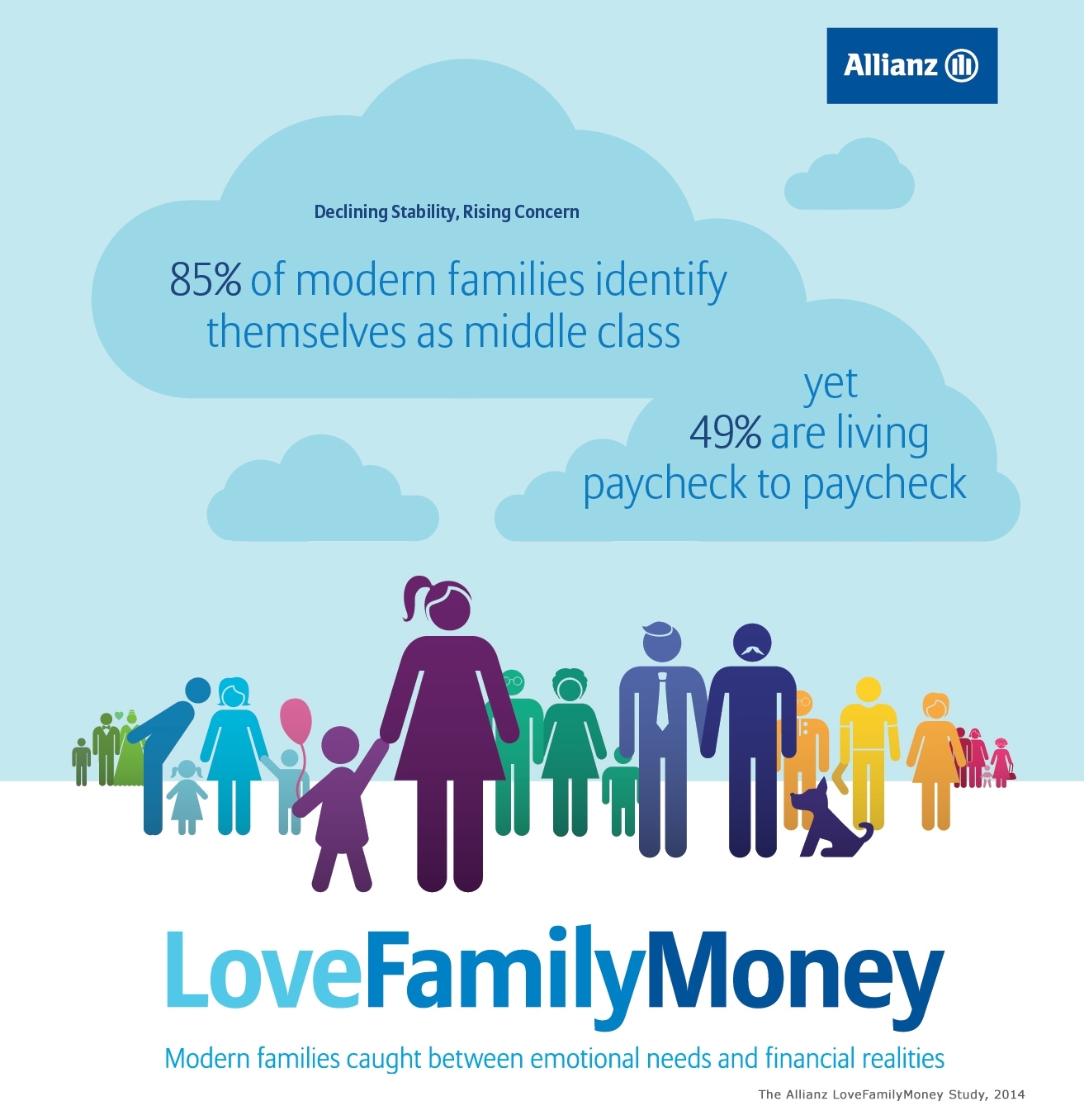

Strategies for Ensuring Financial Security for Families

Financial security is a cornerstone for the well-being of any family. By implementing strategic measures and fostering a proactive mindset, families can build a robust financial foundation. Explore key strategies to ensure lasting financial security for your loved ones.

Creating a Comprehensive Budget

The first step towards financial security involves creating a comprehensive budget. Outline your family’s income sources and allocate funds for essential expenses, savings, and discretionary spending. A well-structured budget provides a clear roadmap for managing finances effectively.

Building an Emergency Fund

An emergency fund is a crucial component of financial security. Allocate a portion of your income to build a safety net capable of covering three to six months’ worth of living expenses. This fund serves as a financial cushion during unexpected events, preventing the need for reliance on credit or loans.

Investing in Insurance Coverage

Insurance plays a pivotal role in safeguarding a family’s financial future. Ensure that you have adequate coverage for health, life, property, and other relevant aspects. Insurance provides a layer of protection, mitigating the financial impact of unforeseen circumstances and emergencies.

Strategic Debt Management

Effectively managing debt is essential for long-term financial security. Prioritize paying off high-interest debts and consider debt consolidation options to streamline repayment. A strategic approach to debt ensures that more of your income is available for savings and building wealth.

Smart Investment Strategies

Investing wisely is a key strategy for long-term financial security. Diversify your investments across different asset classes, such as stocks, bonds, and real estate. Consult with financial professionals to develop an investment strategy aligned with your family’s goals and risk tolerance.

Planning for Education and Retirement

Investing in education and retirement planning is an investment in the future financial security of your family. Contribute to education savings accounts for your children and consistently fund retirement accounts. Early planning allows for the power of compounding to work in your favor.

Regularly Reviewing and Adjusting Financial Goals

Financial goals evolve over time, and it’s essential to regularly review and adjust them. Whether saving for a home, education, or retirement, ensure that your goals align with your family’s current needs and circumstances. Flexibility in goal-setting contributes to sustainable financial security.

Encouraging Financial Literacy Within the Family

Fostering financial literacy within the family is a proactive step towards financial security. Educate family members about budgeting, saving, and making informed financial decisions. Empowering everyone in the family with financial knowledge creates a shared commitment to long-term security.

Establishing Multiple Income Streams

In today’s dynamic economy, establishing multiple income streams enhances financial security. Explore opportunities for side businesses, freelance work, or passive income ventures. Diversifying income sources not only provides financial stability but also prepares the family for unexpected challenges.

Consistent Review and Adaptation

Financial security is an ongoing process that requires consistent review and adaptation. Regularly assess your financial situation, track progress towards goals, and make necessary adjustments. A proactive approach to financial management ensures resilience and long-term security.

For additional insights and resources on ensuring financial security for families, consider visiting Financial Security for Families for valuable tools and guidance. Remember, a secure financial future is built on a foundation of informed decision-making and proactive planning.