![]()

Navigating Family Finances: Effective Debt Management Strategies

Dealing with family debt can be challenging, but with thoughtful strategies and disciplined actions, you can regain control of your financial situation. In this guide, we’ll explore effective debt management strategies to help families overcome financial challenges and build a more secure future.

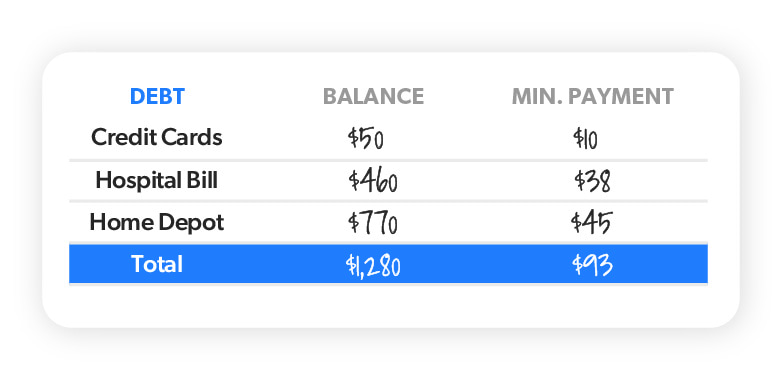

Assessing Your Debt Situation

Before you can effectively manage family debt, it’s crucial to have a clear understanding of your financial situation. Take inventory of all debts, including credit cards, loans, and outstanding bills. Note the interest rates, minimum payments, and total balances. This comprehensive assessment forms the foundation for creating a targeted debt repayment plan.

Prioritizing High-Interest Debt

High-interest debt, such as credit card balances, can quickly become a financial burden. Prioritize these debts in your repayment plan, allocating more resources to pay them down faster. By focusing on high-interest debt first, you can reduce the overall cost of your debt over time.

Creating a Realistic Budget

A well-crafted budget is essential for effective debt management. Outline your monthly income and allocate specific amounts to necessary expenses, savings, and debt repayment. Be realistic about your spending habits and identify areas where you can cut back to allocate more funds toward debt reduction.

Negotiating with Creditors

If you’re struggling to meet your debt obligations, consider reaching out to your creditors. Many creditors are willing to negotiate payment plans or lower interest rates, especially if it helps ensure they receive payment. Open communication can lead to more manageable terms and alleviate some financial pressure.

Consolidating Debts

Debt consolidation involves combining multiple debts into a single, more manageable payment. This can simplify your finances and potentially reduce overall interest costs. Explore options such as a low-interest personal loan or a balance transfer credit card to consolidate high-interest debts.

Building an Emergency Fund

While it may seem counterintuitive, building an emergency fund is a key component of effective debt management. Having savings set aside for unexpected expenses prevents the need to rely on credit in times of crisis, reducing the risk of accumulating more debt.

Seeking Professional Guidance

If managing family debt becomes overwhelming, seek professional advice. Credit counseling services and financial advisors can provide guidance on debt management strategies, budgeting, and financial planning. Their expertise can help you make informed decisions tailored to your family’s unique financial situation.

Exploring Debt Repayment Strategies

Several debt repayment strategies exist, such as the snowball and avalanche methods. The snowball approach involves paying off smaller debts first, providing a sense of accomplishment and motivation. The avalanche method focuses on high-interest debts, minimizing overall interest payments. Choose a strategy that aligns with your financial goals and preferences.

Avoiding Accumulating More Debt

Effective debt management goes beyond repaying existing debts; it involves changing financial habits to prevent further accumulation. Create a plan for responsible credit card use, and be mindful of your spending to avoid falling back into debt.

Celebrating Financial Milestones

As you make progress in reducing family debt, celebrate financial milestones along the way. Acknowledge achievements, whether it’s paying off a credit card or reaching a specific debt reduction goal. Positive reinforcement can help maintain motivation and momentum on your debt management journey.

Discover More at Family Debt Management

For additional resources and tools on effective family debt management, visit firstbasegloves.net. Explore insights and tips to guide your family towards financial stability and a debt-free future.

In conclusion, effective family debt management requires a combination of strategic planning, budgeting, and disciplined actions. By assessing your debt situation, creating a realistic budget, and exploring various debt management strategies, you can navigate challenges and work towards a more secure financial future.