Wealth-Building for Families: Strategies for Lasting Prosperity

Building wealth as a family requires a deliberate and strategic approach. In this guide, we’ll explore key strategies to help families accumulate wealth for lasting prosperity.

Setting Clear Financial Goals

The foundation of wealth accumulation is setting clear financial goals. Whether it’s buying a home, funding education, or planning for retirement, defining specific objectives provides direction for your family’s wealth-building journey. Break down larger goals into smaller, achievable milestones to celebrate progress along the way.

Creating and Following a Budget

A disciplined approach to budgeting is essential for wealth accumulation. Develop a comprehensive budget that allocates income to essential expenses, savings, and investments. Regularly track and adjust your budget to ensure it aligns with your family’s financial goals. Consistent adherence to a budget is a powerful tool for building wealth over time.

Investing for the Long Term

Strategic investments are a key driver of wealth accumulation. Diversify your investment portfolio to spread risk and enhance potential returns. Consider long-term investment options, such as retirement accounts and index funds, to capitalize on compounding returns over the years. Seek professional advice to tailor your investment strategy to your family’s financial goals.

Real Estate as a Wealth-Building Tool

Real estate can be a powerful tool for wealth accumulation. Consider homeownership and strategic property investments as avenues to build equity over time. Real estate often appreciates, providing families with both a place to live and a valuable asset that contributes to long-term wealth.

Prioritizing Education and Skill Development

Investing in education and skill development is an investment in future earning potential. Encourage family members to pursue continuous learning and skill enhancement. Higher education and advanced skills can lead to increased income, opening up more opportunities for wealth accumulation.

Strategic Debt Management

Effective debt management is a crucial aspect of wealth-building. Prioritize low-interest debt and focus on paying it off strategically. This approach frees up resources for savings and investments. However, not all debt is detrimental—strategic use of debt for appreciating assets, such as real estate or education, can contribute to wealth accumulation.

Emergency Fund and Insurance

Protecting your family’s financial foundation is essential for long-term wealth accumulation. Build and maintain an emergency fund to cover unexpected expenses, preventing the need to dip into investments or take on high-interest debt during challenging times. Additionally, ensure you have adequate insurance coverage for health, life, and property to mitigate potential risks.

Passing on Financial Literacy

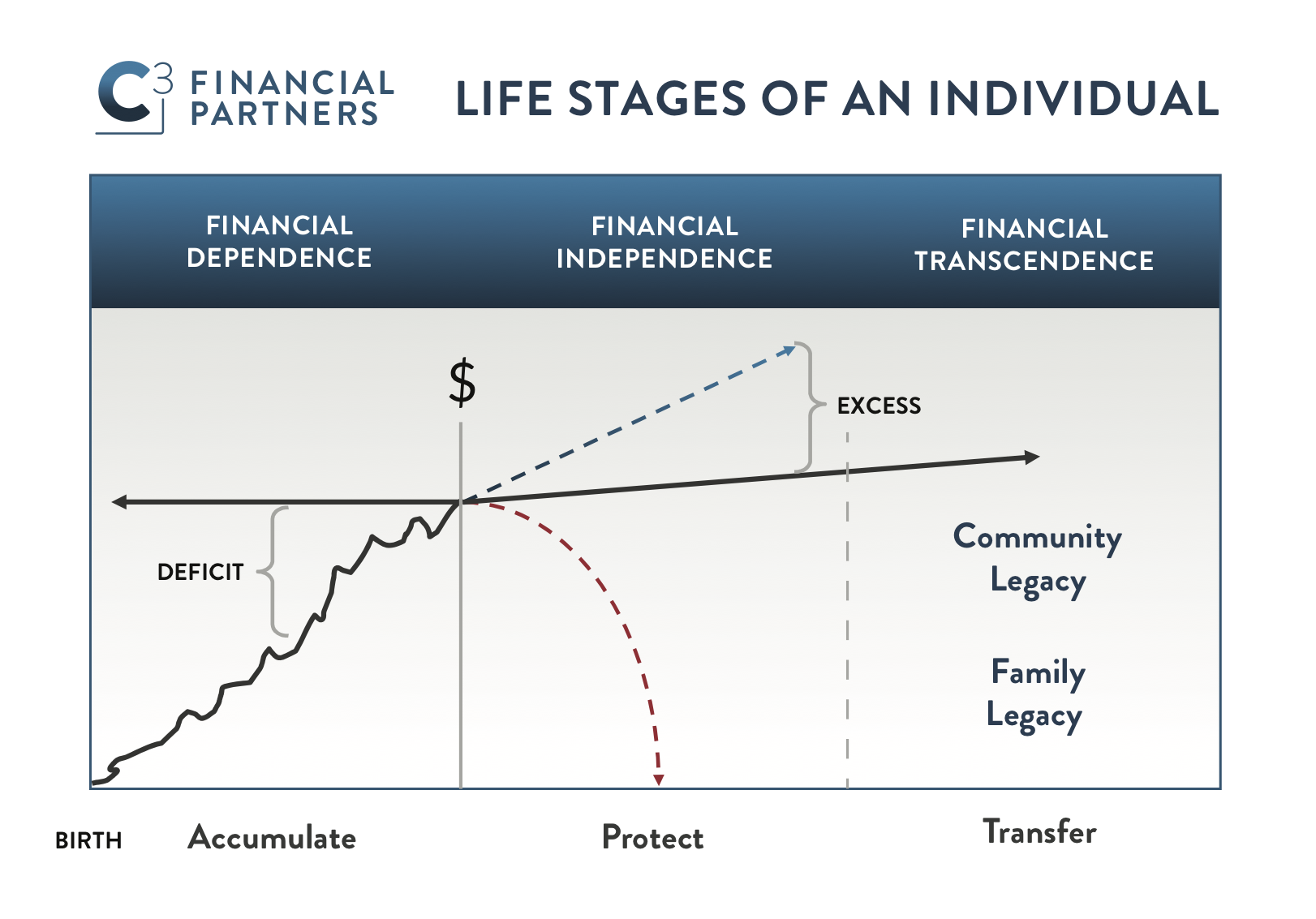

Wealth accumulation is not only about the present; it’s about securing the financial future of generations to come. Instill financial literacy in younger family members by teaching them about budgeting, saving, and investing. Building a legacy of financial knowledge contributes to the long-term prosperity of your family.

Regularly Reviewing and Adjusting Strategies

Wealth-building strategies should be dynamic, adapting to changing circumstances and goals. Regularly review and adjust your financial strategies as your family evolves. Changes in income, family size, and economic conditions may require modifications to ensure your wealth-building plan remains effective and aligned with your aspirations.

Explore More at Family Wealth Accumulation

For additional resources and insights on family wealth accumulation, visit firstbasegloves.net. Discover tools and tips to support your family’s journey towards lasting prosperity.

In conclusion, wealth accumulation for families is a gradual and intentional process. By setting clear goals, adhering to a disciplined budget, making strategic investments, and prioritizing financial education, your family can build lasting prosperity and a secure financial future.