Empowering Futures: A Guide to Family Financial Empowerment

Embarking on the journey of family financial empowerment is a transformative step towards creating lasting prosperity. In this guide, we’ll explore the principles and strategies that can empower families to take control of their financial destinies.

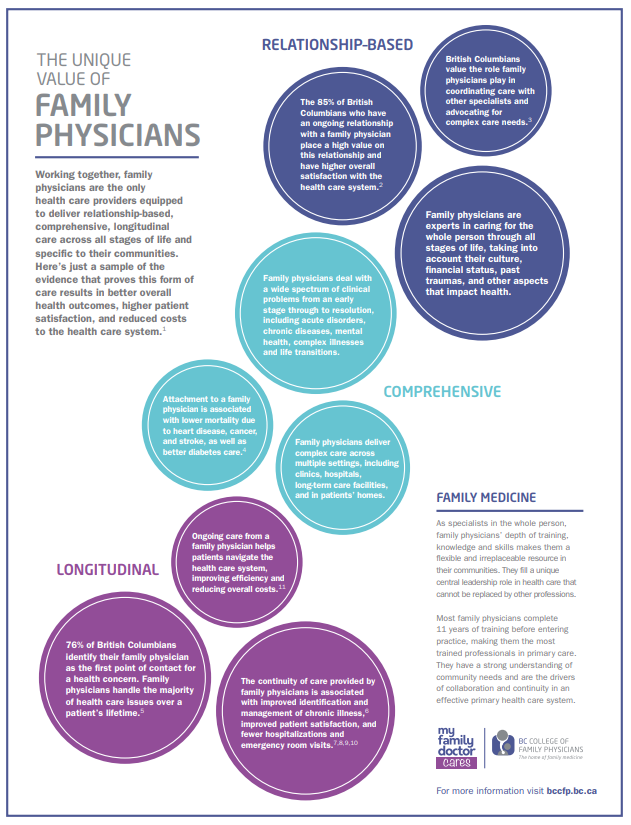

Understanding Family Financial Empowerment

Family financial empowerment is more than just managing money; it’s about cultivating a mindset of control, awareness, and growth. It involves equipping family members with the knowledge and skills to make informed financial decisions, fostering a sense of empowerment over their economic well-being.

Building a Solid Financial Foundation

The first step in family financial empowerment is establishing a solid financial foundation. This includes creating a budget, saving for emergencies, and managing debt. A strong foundation provides stability, allowing families to weather unexpected financial storms and pursue long-term financial goals.

Setting Financial Goals as a Family

Family financial empowerment thrives on setting clear financial goals that align with the collective aspirations of the household. Whether saving for education, a home, or retirement, having shared goals creates a sense of purpose and unity. Families can discuss and prioritize these goals to ensure everyone is working towards a common vision.

Encouraging Financial Education

Empowering a family financially begins with education. Teach family members about budgeting, saving, investing, and understanding financial terms. Financial literacy is a powerful tool that equips individuals with the confidence to make informed decisions and adapt to changing economic landscapes.

Fostering Open Communication about Finances

Transparency and communication are cornerstones of family financial empowerment. Encourage open discussions about money matters within the family. This includes regular financial check-ins, discussing financial goals, and addressing concerns. Open communication reduces financial stress and fosters a collaborative approach to decision-making.

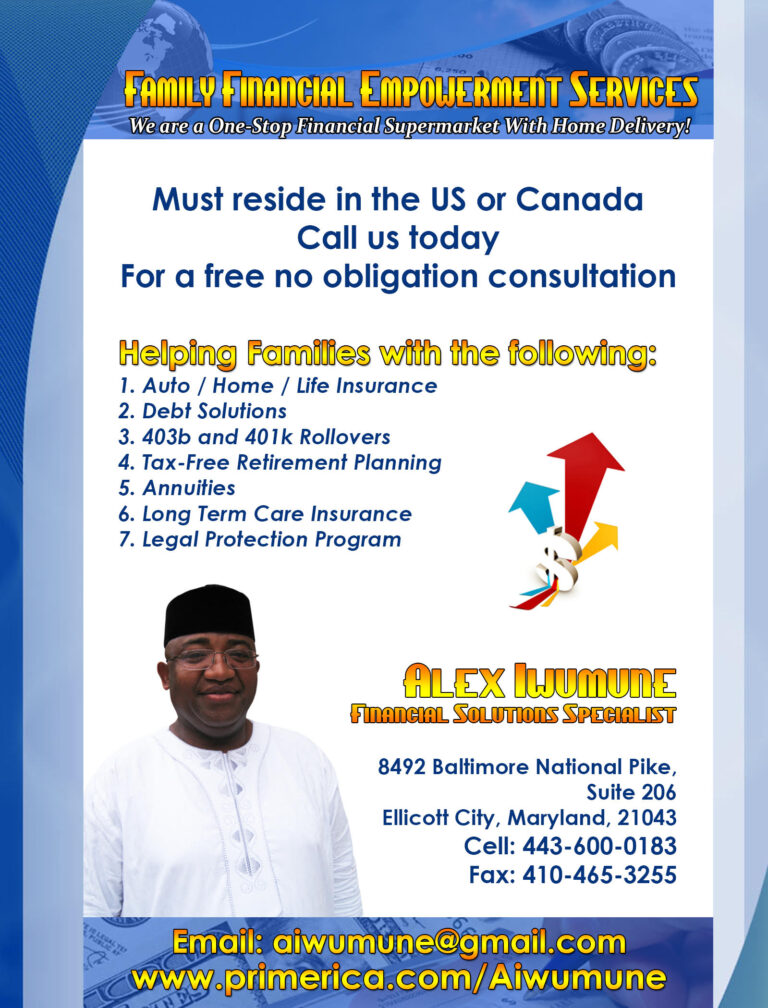

Investing in Financial Tools and Resources

Utilizing financial tools and resources is a key aspect of family financial empowerment. From budgeting apps to investment platforms, technology offers numerous resources to streamline financial management. Consider integrating tools like Family Financial Empowerment for a comprehensive approach to managing and tracking family finances.

Cultivating a Savings Mindset

A savings mindset is integral to family financial empowerment. Encourage regular saving habits and demonstrate the value of delayed gratification. Whether through an emergency fund, retirement savings, or education funds, cultivating a savings mindset instills financial discipline and resilience.

Exploring Investment Opportunities

To empower a family financially, consider exploring investment opportunities beyond traditional savings. Investments can include stocks, bonds, real estate, or starting a small business. Diversifying investments can potentially lead to increased wealth over time, contributing to the family’s financial empowerment.

Teaching Responsible Spending Habits

Financial empowerment involves teaching responsible spending habits. Help family members differentiate between needs and wants, make informed purchasing decisions, and avoid unnecessary debt. Responsible spending habits contribute to long-term financial stability and empowerment.

Embracing Family Financial Empowerment: A Holistic Approach

To fully embrace family financial empowerment, consider leveraging dedicated platforms like Family Financial Empowerment. This holistic tool provides a centralized hub for budgeting, goal-setting, and financial tracking. Integrating such tools enhances the family’s ability to navigate their financial journey with confidence and empowerment.

In conclusion, family financial empowerment is a dynamic and continuous process. By understanding its principles, setting clear goals, fostering financial education, and utilizing tools like Family Financial Empowerment, families can cultivate a resilient and empowered financial future. Empowerment begins with knowledge, grows through shared goals, and thrives in an environment of open communication and responsible financial habits.