Breaking Free from Financial Burdens: Family Debt Elimination Plan

Dealing with debt can be overwhelming, but with a well-structured plan, families can break free from financial burdens. Explore effective strategies and steps to create a Family Debt Elimination Plan and pave the way for financial freedom.

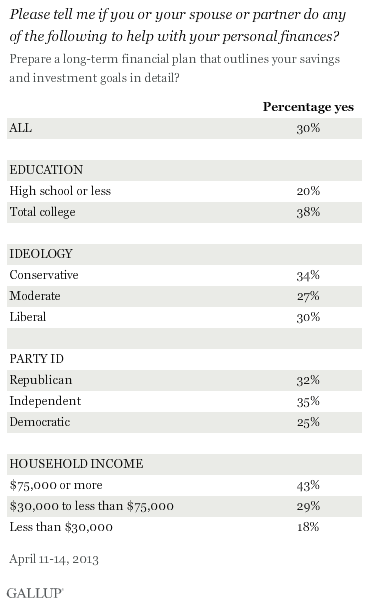

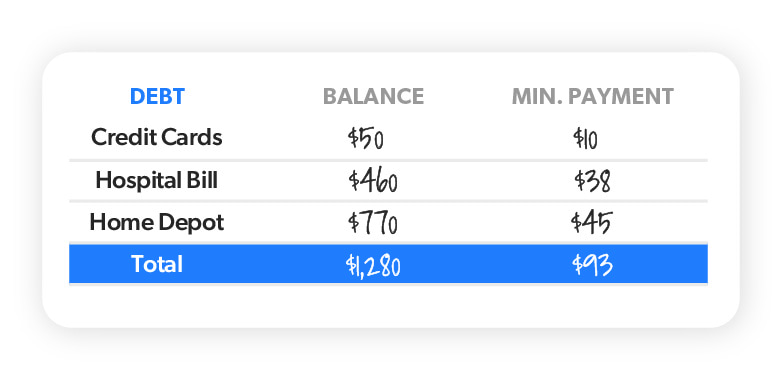

Assessing the Current Debt Situation

The first step in crafting a Family Debt Elimination Plan is to assess the current debt situation. Compile a comprehensive list of all outstanding debts, including credit cards, loans, and any other financial obligations. Understanding the full scope of debt is crucial for developing a targeted plan.

Prioritizing Debts for Repayment

Not all debts are created equal. Prioritize debts for repayment based on interest rates. Tackle high-interest debts first to minimize the overall financial burden. Creating a repayment order ensures that every dollar spent on debt elimination has the maximum impact on reducing interest.

Creating a Realistic Budget for Debt Repayment

A realistic budget is the backbone of a Family Debt Elimination Plan. Allocate a specific amount of income towards debt repayment, in addition to covering essential expenses. Cutting back on discretionary spending may be necessary to accelerate debt elimination and increase available funds for repayment.

Exploring Debt Consolidation Options

Debt consolidation can simplify the repayment process. Explore options to consolidate multiple debts into a single, more manageable loan with a lower interest rate. This approach streamlines payments and may result in significant savings over the course of the repayment plan.

Negotiating with Creditors for Favorable Terms

Don’t hesitate to negotiate with creditors for more favorable terms. Many creditors are willing to work with individuals and families facing financial challenges. Discussing options such as lower interest rates or extended repayment schedules can make debt elimination more achievable.

Building and Maintaining an Emergency Fund

While focusing on debt elimination, it’s crucial to simultaneously build and maintain an emergency fund. Having a financial safety net prevents the need to rely on credit cards or loans in the face of unexpected expenses, ultimately supporting the debt elimination process.

Cutting Unnecessary Expenses

To accelerate debt elimination, evaluate and cut unnecessary expenses. This might involve reassessing subscription services, finding more cost-effective alternatives for everyday items, or making temporary lifestyle adjustments. Redirecting funds towards debt repayment is a powerful strategy for faster progress.

Celebrating Milestones and Staying Motivated

Debt elimination is a journey, and celebrating milestones along the way is essential for staying motivated. As each debt is paid off, take a moment to acknowledge the achievement. Tracking progress and maintaining a positive mindset contribute to the overall success of the Family Debt Elimination Plan.

Seeking Professional Financial Advice

If managing debt becomes overwhelming, seeking professional financial advice is a prudent step. Financial advisors can provide guidance on debt management strategies, budgeting, and long-term financial planning. Their expertise can be invaluable in navigating complex financial situations.

For additional insights and tools on creating a Family Debt Elimination Plan, consider visiting Family Debt Elimination Plan for resources that can enhance your debt management strategies. Remember, with dedication and a well-crafted plan, families can successfully eliminate debt and work towards financial freedom.