Mastering Efficiency: Family Money Management Unveiled

Efficient family money management is a cornerstone for achieving financial stability and prosperity. In this article, we’ll explore effective strategies that empower families to optimize their financial resources and build a solid foundation for the future.

Understanding Family Financial Goals

Efficient money management begins with a clear understanding of family financial goals. Whether it’s saving for education, buying a home, or planning for retirement, aligning financial strategies with specific objectives provides direction and purpose. Take the time to identify short-term and long-term goals to shape the family’s financial roadmap.

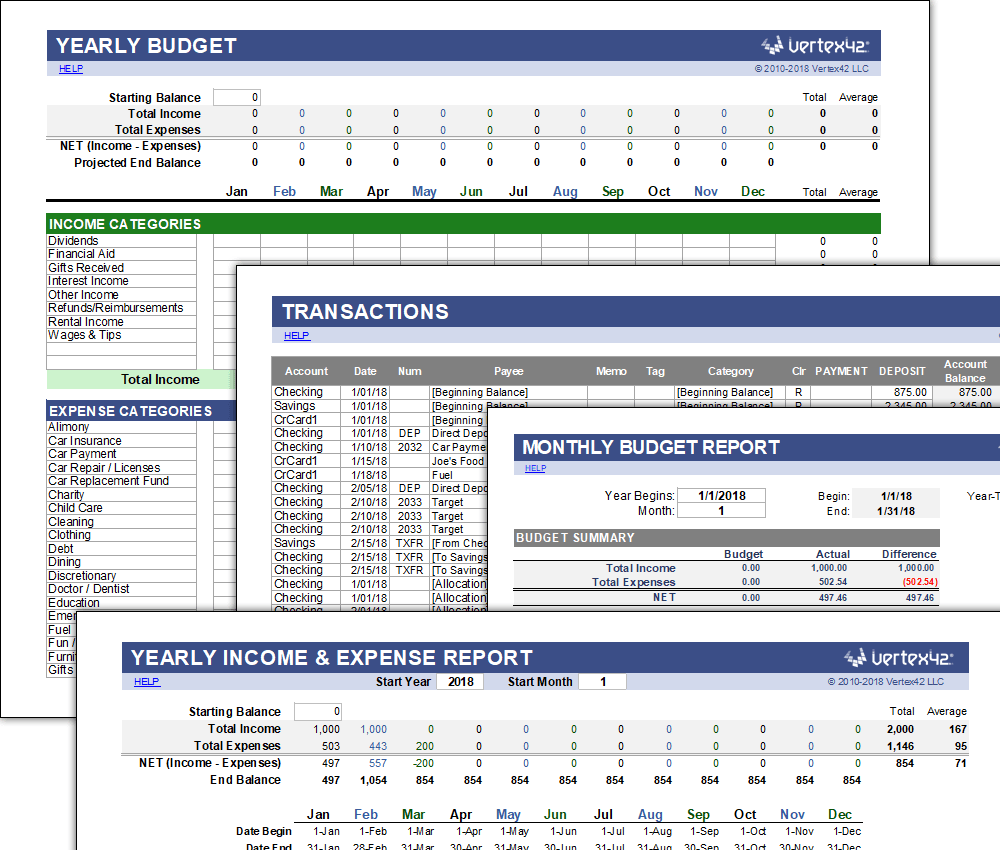

Creating a Comprehensive Budget

A well-crafted budget forms the backbone of efficient family money management. Start by listing all sources of income and categorizing expenses. A detailed budget allows families to track spending, identify areas for savings, and allocate resources according to priorities. Regularly reviewing and adjusting the budget ensures it remains aligned with changing financial circumstances.

Embracing Frugal Living

Efficiency in family money management often involves embracing frugal living without sacrificing quality of life. Evaluate spending habits and seek cost-effective alternatives without compromising on essentials. Embracing frugality allows families to save more and allocate resources towards financial goals with intention.

Leveraging Technology for Financial Tracking

In the digital age, technology offers valuable tools for efficient financial management. Utilize budgeting apps, expense trackers, and online banking to streamline financial tracking. Technology not only simplifies money management but also provides real-time insights into spending patterns, enabling informed financial decisions.

Implementing an Automated Savings Plan

Efficient family money management benefits from automation. Set up automated transfers to savings accounts or investment portfolios. Automation ensures consistent contributions to savings goals without relying on manual efforts, promoting financial discipline and goal attainment.

Prioritizing Debt Repayment Strategies

Effectively managing family finances involves addressing outstanding debts. Prioritize high-interest debts and implement strategic repayment plans. Reducing debt not only saves money on interest payments but also frees up resources for other financial priorities.

Investing for Long-Term Growth

Efficient family money management extends to strategic investments. Explore investment opportunities aligned with the family’s risk tolerance and financial goals. Long-term investments in stocks, bonds, or real estate can contribute to wealth accumulation and financial growth over time.

Building and Maintaining an Emergency Fund

Financial emergencies can arise unexpectedly, emphasizing the importance of having an emergency fund. Allocate a portion of income to build and maintain a robust emergency fund. This fund provides a financial safety net, preventing unforeseen expenses from derailing the family’s financial stability.

Regularly Reviewing and Adjusting Strategies

Efficient family money management is an evolving process. Regularly review financial strategies and make adjustments as needed. Life circumstances change, goals may shift, and economic conditions fluctuate. Proactive adjustments ensure that the family’s money management strategies remain relevant and effective.

Educating Family Members on Financial Literacy

Promoting financial literacy within the family is a key component of efficient money management. Educate family members on budgeting, saving, investing, and making informed financial decisions. A collective understanding of financial principles empowers the entire family to contribute to effective money management.

Efficient Family Money Management: A Path to Financial Well-Being

In conclusion, efficient family money management is a dynamic and intentional process that involves planning, discipline, and adaptability. By aligning spending with goals, embracing frugality, and leveraging technology, families can navigate their financial journey with confidence. Efficient money management not only ensures financial stability but also sets the stage for a prosperous future.

For valuable insights and resources on efficient family money management, visit Efficient Family Money Management.