Family Goals Budgeting: Financial Planning for Success

Budgeting for family goals is a strategic approach that empowers families to turn aspirations into reality. In this guide, we’ll delve into effective budgeting practices tailored to achieving your family’s goals, ensuring financial success.

Define Clear and Attainable Goals

The foundation of successful family goals budgeting lies in defining clear and attainable objectives. Whether it’s saving for a dream vacation, funding education, or purchasing a home, articulate your goals. Clarity in your aspirations provides direction for creating a purposeful budget.

Create a Detailed Family Budget

Crafting a detailed family budget is the first practical step towards goal-oriented financial planning. Categorize expenses, allocate funds for necessities, and set aside specific amounts for each goal. A well-organized budget serves as a roadmap for efficient money management.

Prioritize and Set Timelines

Not all goals are equal, and effective family goals budgeting involves prioritization. Determine which goals are most urgent or have a set timeline. Prioritizing ensures that essential needs are met while allocating resources to meet specific goals within the desired timeframe.

Allocate Specific Budget Categories

Tailor your budget to include specific categories for each family goal. If you’re saving for a home, create a dedicated category for the down payment. If education is a goal, allocate funds for tuition, books, and related expenses. Specific budget categories enhance focus and tracking.

Regularly Review and Adjust Budget

Family goals and financial situations evolve, necessitating regular budget reviews. Set aside time periodically to assess progress, make adjustments, and reallocate funds as needed. Adapting your budget ensures it remains aligned with changing circumstances and evolving aspirations.

Explore Ways to Increase Income

Effective family goals budgeting not only involves managing expenses but also exploring ways to increase income. Consider additional income streams, side businesses, or freelance opportunities to accelerate progress toward your financial objectives.

Utilize Technology for Budgeting

Leverage technology to streamline the budgeting process. Use budgeting apps and financial tools to track income, expenses, and progress towards goals. Technology provides real-time insights, making it easier to stay on top of your family’s financial plan.

Celebrate Milestones Along the Way

As you make strides towards your family goals, take the time to celebrate milestones. Whether it’s reaching a savings target or achieving a specific financial goal, acknowledging successes along the way reinforces commitment and motivates continued financial discipline.

Emergency Fund for Unforeseen Expenses

Incorporate an emergency fund into your family goals budgeting strategy. An emergency fund provides a financial safety net, preventing unforeseen expenses from derailing progress towards your goals. Aim to save at least three to six months’ worth of living expenses.

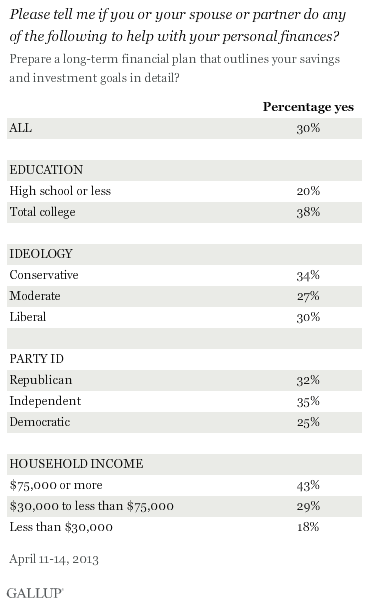

Seek Professional Financial Advice

For complex financial goals or if you’re unsure where to start, consider seeking professional financial advice. A certified financial planner can provide personalized guidance, helping your family make informed decisions and navigate the path towards achieving your aspirations.

Explore More at Budgeting for Family Goals

For additional resources and insights on effective budgeting for family goals, visit firstbasegloves.net. Discover tools and tips to support your family’s journey towards financial success through strategic goal-oriented budgeting.

In conclusion, family goals budgeting is a dynamic and empowering process. By defining clear goals, creating a detailed budget, and adapting to changing circumstances, your family can turn aspirations into tangible achievements, fostering long-term financial success.