:max_bytes(150000):strip_icc()/girlsopeningpresents-fd61caee5d4b4898a7aa670a6e796c35.jpg)

Navigating Financial Wellness: Embracing a Budget-Focused Family Lifestyle

Achieving financial wellness is not just about income; it’s about how you manage and allocate your resources. In this guide, we’ll explore the concept of a budget-focused family lifestyle, outlining strategies and practices that empower families to thrive within their financial means.

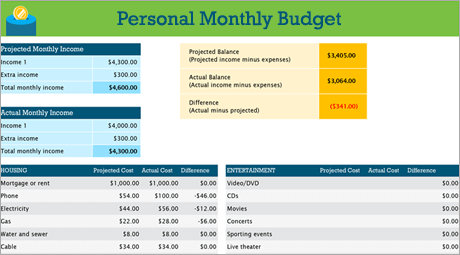

The Foundation: Crafting a Family Budget

At the core of a budget-focused family lifestyle is the creation of a comprehensive family budget. Begin by meticulously listing all sources of income and categorizing expenses. Distinguish between fixed costs like mortgage or rent and variable expenses such as groceries and entertainment. Crafting a family budget is the first step in gaining a clear understanding of your financial landscape.

Setting Priorities: Needs vs. Wants

A budget-focused family lifestyle involves a conscious effort to distinguish between needs and wants. Prioritize essential expenses that contribute to the well-being and security of your family. While some wants are valid, aligning spending habits with true priorities ensures that your budget is directed towards the most meaningful and necessary areas of your family’s life.

Building the Emergency Fund: Financial Security Net

In the journey towards a budget-focused family lifestyle, building and maintaining an emergency fund is paramount. This fund serves as a safety net during unexpected financial challenges, preventing the need to rely on credit cards or loans. Aim to save at least three to six months’ worth of living expenses to bolster your family’s financial security.

Smart Spending Habits: Quality over Quantity

Embracing a budget-focused family lifestyle involves adopting smart spending habits. Prioritize quality over quantity, seeking value in the items and experiences you invest in. This approach not only reduces unnecessary expenses but also promotes a mindset of mindful and intentional consumption, contributing to long-term financial wellness.

Thrifty Living: Finding Cost-Effective Alternatives

Living thrifty doesn’t mean sacrificing quality of life; rather, it’s about finding cost-effective alternatives. Explore ways to save on everyday expenses, from shopping for generic brands to utilizing discounts and coupons. The accumulation of small, intentional choices can lead to significant savings over time, aligning with the principles of a budget-focused family lifestyle.

Educating Family Members: Financial Literacy Matters

Incorporating financial literacy into the family dynamic is a key element of a budget-focused family lifestyle. Educate family members, especially children, about the value of money, budgeting, and smart financial decision-making. This shared understanding fosters a collaborative approach to managing finances and strengthens the family’s commitment to the budget-focused lifestyle.

Investing in Quality: Long-Term Savings Strategy

Part of a budget-focused family lifestyle is recognizing when to invest in quality. While cost-cutting is essential, there are instances where investing in durable, long-lasting items can save money in the long run. Assess your family’s needs and determine where quality investments align with your budget and contribute to long-term savings.

Mindful Debt Management: Strategic Repayment Plans

Addressing and managing debt is a crucial component of a budget-focused family lifestyle. Develop strategic repayment plans, focusing on high-interest debts first. Explore debt consolidation options and negotiate lower interest rates where possible. Proactive debt management frees up financial resources for savings and investments, enhancing your family’s overall financial health.

Celebrating Financial Milestones: Reinforcing Habits

As your family progresses in adopting a budget-focused lifestyle, celebrate financial milestones. Whether it’s paying off a credit card, reaching a savings goal, or successfully adhering to the budget for a specified period, acknowledge and celebrate these achievements. Positive reinforcement strengthens the commitment to a budget-focused family lifestyle.

The Role of Budget-Focused Family Lifestyle: Leveraging Tools for Success

In the pursuit of a budget-focused family lifestyle, leverage tools and resources to streamline the process. The Budget-Focused Family Lifestyle platform provides a user-friendly interface for managing budgets, tracking expenses, and setting financial goals. Integrating such tools enhances your family’s ability to navigate the budget-focused lifestyle with efficiency and success.

In conclusion, embracing a budget-focused family lifestyle is a transformative journey towards financial wellness. By crafting a comprehensive budget, setting priorities, building an emergency fund, adopting smart spending habits, and utilizing tools like the Budget-Focused Family Lifestyle platform, your family can thrive within its financial means. The intentional choices made along this journey contribute not only to immediate financial health but also to a secure and prosperous future.