Charting a Course to Financial Freedom: The Family Debt Reduction Plan

Navigating the path to financial freedom often involves confronting and conquering debt. A family debt reduction plan is a strategic roadmap that empowers families to break free from the shackles of debt and pave the way for a secure and prosperous future. In this article, we’ll delve into the essential components of a family debt reduction plan, offering insights and actionable steps towards achieving a debt-free life.

Assessing the Current Financial Landscape: Understanding Debt Obligations

The first step in crafting a family debt reduction plan is to assess the current financial landscape. Take stock of all existing debts, including credit cards, loans, and any outstanding balances. Understand the interest rates, minimum payments, and total outstanding amounts. This comprehensive overview forms the foundation for developing an effective debt reduction strategy.

Prioritizing Debts: Tackling High-Interest Obligations First

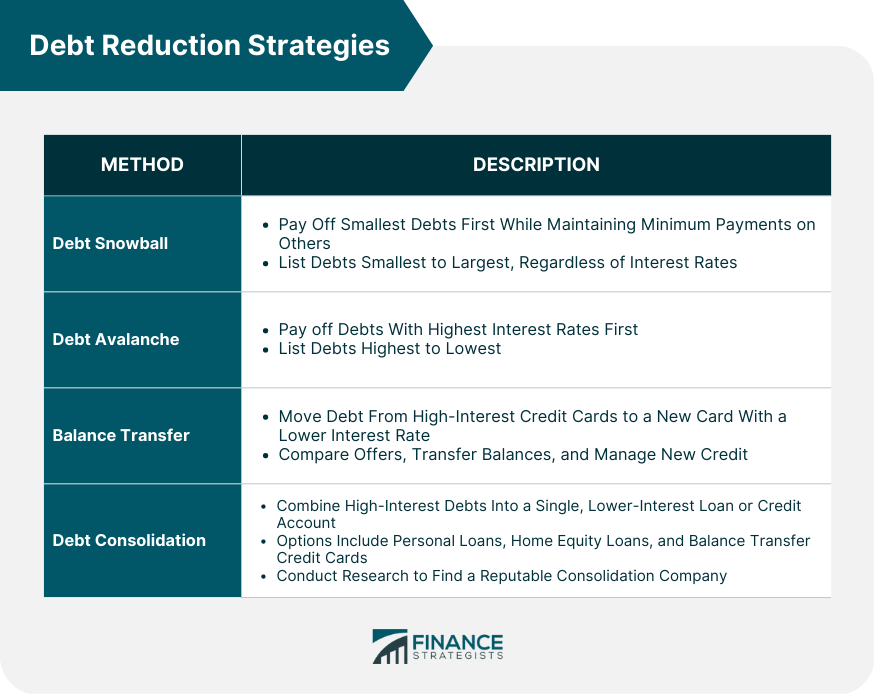

Not all debts are created equal, and a strategic family debt reduction plan prioritizes tackling high-interest obligations first. Identify debts with the highest interest rates and focus on repaying them aggressively. By addressing high-interest debts early, families can minimize the long-term financial burden and accelerate their journey towards becoming debt-free.

Creating a Realistic Budget: Aligning Income with Debt Reduction Goals

A realistic budget is a cornerstone of any effective family debt reduction plan. Evaluate all sources of income and categorize essential expenses. Allocate a significant portion of income to debt repayment while ensuring that the family’s basic needs are met. A well-balanced budget provides a clear roadmap for managing finances and achieving debt reduction goals.

Implementing the Snowball or Avalanche Method: Strategies for Repayment

Two popular strategies for debt repayment are the snowball and avalanche methods. The snowball method involves paying off the smallest debts first, providing a psychological boost as smaller debts are eliminated. The avalanche method focuses on high-interest debts, minimizing overall interest payments. Choosing the right strategy depends on individual preferences and financial goals.

Negotiating with Creditors: Exploring Options for Relief

Families facing financial hardship should explore options for negotiating with creditors. Many creditors are willing to work with individuals facing difficulties, offering reduced interest rates, extended repayment plans, or debt settlement options. Engaging in open communication with creditors can lead to mutually beneficial arrangements that facilitate the debt reduction process.

Building an Emergency Fund: Safeguarding Against Future Debt

A family debt reduction plan is incomplete without addressing the potential for future financial challenges. Building and maintaining an emergency fund serves as a financial safety net, preventing the need to rely on credit in times of unexpected expenses. An emergency fund safeguards against accumulating additional debt, reinforcing the family’s commitment to financial stability.

Exploring Additional Income Streams: Supplementing Debt Repayment Efforts

Supplementing the family budget with additional income streams accelerates the debt reduction process. Family members can explore side hustles, freelancing, or part-time work to increase overall income. The additional funds generated can be directed towards debt repayment, providing a powerful boost to the effectiveness of the family debt reduction plan.

Seeking Professional Financial Advice: Expert Guidance for Success

For families facing complex financial challenges, seeking professional financial advice is a wise step. Financial advisors can provide tailored strategies, debt consolidation options, and expert guidance on navigating the intricacies of debt reduction. Consulting with professionals enhances the family’s ability to make informed decisions and achieve sustainable debt reduction.

Celebrating Milestones: Reinforcing Commitment and Progress

Throughout the debt reduction journey, celebrating milestones is crucial. Whether it’s paying off a specific debt, reaching a certain percentage of overall reduction, or achieving a set financial goal, milestones reinforce the family’s commitment and progress. Celebrations serve as motivational markers, energizing the family to persevere on the path to becoming debt-free.

Committing to Financial Discipline: Sustaining a Debt-Free Lifestyle

The ultimate goal of a family debt reduction plan is not just to eliminate existing debts but to cultivate financial discipline for a debt-free future. As debts are repaid, families must commit to maintaining the budgetary habits and financial discipline developed during the debt reduction process. This commitment ensures a sustainable and prosperous financial future.

Linking It All Together: A Debt-Free Future Awaits

In conclusion, a well-crafted family debt reduction plan is a transformative tool that empowers families to conquer debt and embark on a journey towards financial freedom. By assessing the current financial landscape, prioritizing debts, implementing strategic repayment methods, and committing to financial discipline, families can pave the way for a debt-free and prosperous future.

For valuable insights and resources on implementing a family debt reduction plan, visit Family Debt Reduction Plan.