Navigating Family Fun on a Budget: Introduction

Budgeting for family activities is a key component of responsible financial management. In this article, we explore practical strategies for families to enjoy quality time together without straining their finances. Let’s delve into smart budgeting techniques that allow families to strike a balance between entertainment and fiscal responsibility.

Creating a Family Activity Budget: The Foundation of Financial Planning

The first step in budgeting for family activities is to create a dedicated budget category. Allocate a portion of your overall budget specifically for recreational and entertainment expenses. This ensures that family activities are planned and accounted for within the broader financial framework.

Prioritizing Activities Based on Interests and Values

Not all family activities come with the same price tag, and prioritizing based on interests and values is essential. Identify activities that align with your family’s preferences and values. This targeted approach allows you to focus on experiences that bring joy without breaking the bank.

Exploring Cost-Free and Low-Cost Activities: Quality Fun on a Budget

Budgeting for family activities doesn’t mean sacrificing fun. Explore cost-free and low-cost activities that offer quality entertainment. Parks, nature trails, community events, and local attractions often provide enjoyable experiences without a significant financial burden.

Taking Advantage of Seasonal and Promotional Offers

Family budgets can benefit from taking advantage of seasonal and promotional offers. Many attractions and activities offer discounted rates during specific seasons or promotional periods. Keeping an eye on such opportunities allows families to enjoy their favorite activities at a fraction of the regular cost.

DIY Family Fun: Crafting Memories on a Budget

Engaging in do-it-yourself (DIY) family activities is a creative and budget-friendly way to bond. From crafting sessions to home movie nights, DIY activities allow families to create lasting memories without spending a fortune. Embracing creativity enhances the experience while keeping costs low.

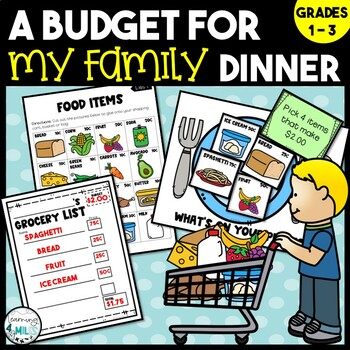

Meal Planning for Outings: Nourishing Bodies and Budgets

Family outings often involve meals, and strategic meal planning can contribute significantly to budgeting for activities. Pack snacks and lunches when heading out, and consider choosing destinations with affordable dining options. This approach ensures that dining expenses are part of the budgeting strategy.

Utilizing Family Memberships and Loyalty Programs

Maximize savings by exploring family memberships and loyalty programs. Many attractions, museums, and entertainment venues offer memberships that provide discounted or unlimited access for a fixed fee. Loyalty programs can also accumulate points for future discounts on family activities.

Setting Realistic Expectations: Aligning Budget with Family Goals

While budgeting for family activities is essential, setting realistic expectations is equally crucial. Align the budget with your family’s overall financial goals and priorities. Being mindful of your financial limits allows you to enjoy activities guilt-free while staying on track with broader financial objectives.

Regularly Reviewing and Adjusting the Activity Budget

Budgeting is a dynamic process, and the family activity budget should be regularly reviewed and adjusted. Assess your spending patterns, consider any changes in income, and adapt the budget accordingly. This ongoing evaluation ensures that your family’s budgeting strategy remains effective over time.

Incorporating these smart budgeting strategies into family activities cultivates a harmonious balance between entertainment and financial responsibility. Explore resources like FirstBaseGloves.net for additional insights and tools to enhance your family’s understanding of budgeting for activities. By adopting a strategic approach, your family can create memorable experiences while maintaining a stable and healthy financial outlook.